Imagine losing a majority of your life savings because you thought you were helping the Department of Homeland Security uncover clues in a financial negligence investigation.

That’s just what happened to a client of Bremer Consumer Bank Team Lead Runea Huseby, who said the scam cost her client six figures in three months’ time.

“He even had mail and paper records that looked very convincing and official,” Runea said.

Runea and her colleague Rammie Olson, VP business relationship manager, spoke at Eventide University where they shared real-life examples of scams that affect older people like the homeland security one.

“It was a sophisticated scam, one that we recognized right away because of our experience in scam prevention. Unfortunately, many people who aren’t as experienced in fraud as we are, like our client, didn’t realize it until it was too late,” Runea said.

During their talk at Eventide University, Runea and Rammie also shared some tools and tips with us that will help you and your loved ones stay protected from scams. Here’s what we learned.

Q&A with Runea and Rammie from Bremer

Why do scams work?

Bremer: Scammers are masters of persuasion. They’ll tell you a story they want you to believe and hook into that vulnerable part of you. Scammers are going to play with an emotional part of who you and latch onto what’s important to you.

For example, if you like to give back to charities, scammers are going to try to pinpoint or pick up on that and hook and sink for various reasons. They’re going to quickly try and gain your trust by speaking to your feelings and good heart. They’re also not going to give you an opportunity to say no and pressure you into making a quick decision about your finances.

How do scammers find you?

Bremer: Scammers might find you online. There’s various sites available where public information is present for people and all you have to do to access that information is pay a little fee. They also go online and look at your social media.

Scammers may also start going out to groups that you would like to attend, such as veterans groups, women’s networks that you may go out and connect with in the community.

Scammers could also potentially be as bold as going door to door to your friends or families places or even rooms and look to solicit you in that lens to see what you have.

What are some common types of scams?

Bremer: There’s one where scammers pretend they are from Norton antivirus and ask the victim for access to their computer so they can fix the problem. Then they’ll take over the client’s computer and have the client enter their bank information. And then they’ll go in and deplete the client’s bank account.

There’s also giveaway scams where someone gets a letter in the mail that says they won $50,000, but they need to pay $3,500 in taxes up front via wire transfer. The victim is also advised to not notify their bank.

Imposter scams are popular, too, and one we see a lot with vulnerable adults. A scammer may get a phone number of an elderly adult and call them, posing to be a family member. The scammer will say they are in the hospital and need to pay the bill or that they’re in jail and need money to get out. They also advise their victims to not tell anyone in the family. They’ll say stuff like, “This is private, I don’t want anyone to know,” and will do what they can to be as convincing as possible.

We have charity scams. Someone may get a letter or a phone call from a scammer that says they’re giving money to children in Uganda and they need your help immediately. Letters and phone calls look or feel legitimate, and that’s where it can be a little more tricky.

What type of scam are you seeing more frequently?

Bremer: We have seen quite a bit of tax scams in recent years. Unfortunately, what this looks like is people receive letters or calls declaring they are delinquent on their taxes. They’re told they need to make a lump sum payment either by phone, gift cards, or wire transfers.

How do scammers get access to your money?

Bremer: A scammer understands that gift cards, cash wire transfers and official checks are much more difficult to trace, so they will most likely ask their victims for these types of money.

There’s usually a need for immediate action to take place and the scammer needs you to do this now. There’s also the secrecy component of it. They tell their victims to not tell anyone else about their request. They’ll also ask for money up front.

What’s the best way to spot a scam?

Bremer: Most scammers will be very fast, they’ll ask you for money fast and won’t give you time to make decisions. In contrast, any legitimate business asking for money will give you the time you need to make a decision.

Of course, if you are ever unsure if something is real or fake, reach out to a family member, friend, or your bank and ask them to take a look at the situation.

How can your bank help protect you from scams?

Bremer: Banks monitor your accounts, and if they see large sums of money being withdrawn, or suspect unusual activity, like transactions in Mexico when you’re at the lake cabin, your bank will likely check up on you and see if these notifications are legitimate.

Other tips from Bremer

- Limit junk mail

- Register on the national Do Not Call Registry

- Consider adding authorized contacts to accounts of vulnerable clients

More information about elder fraud and scams

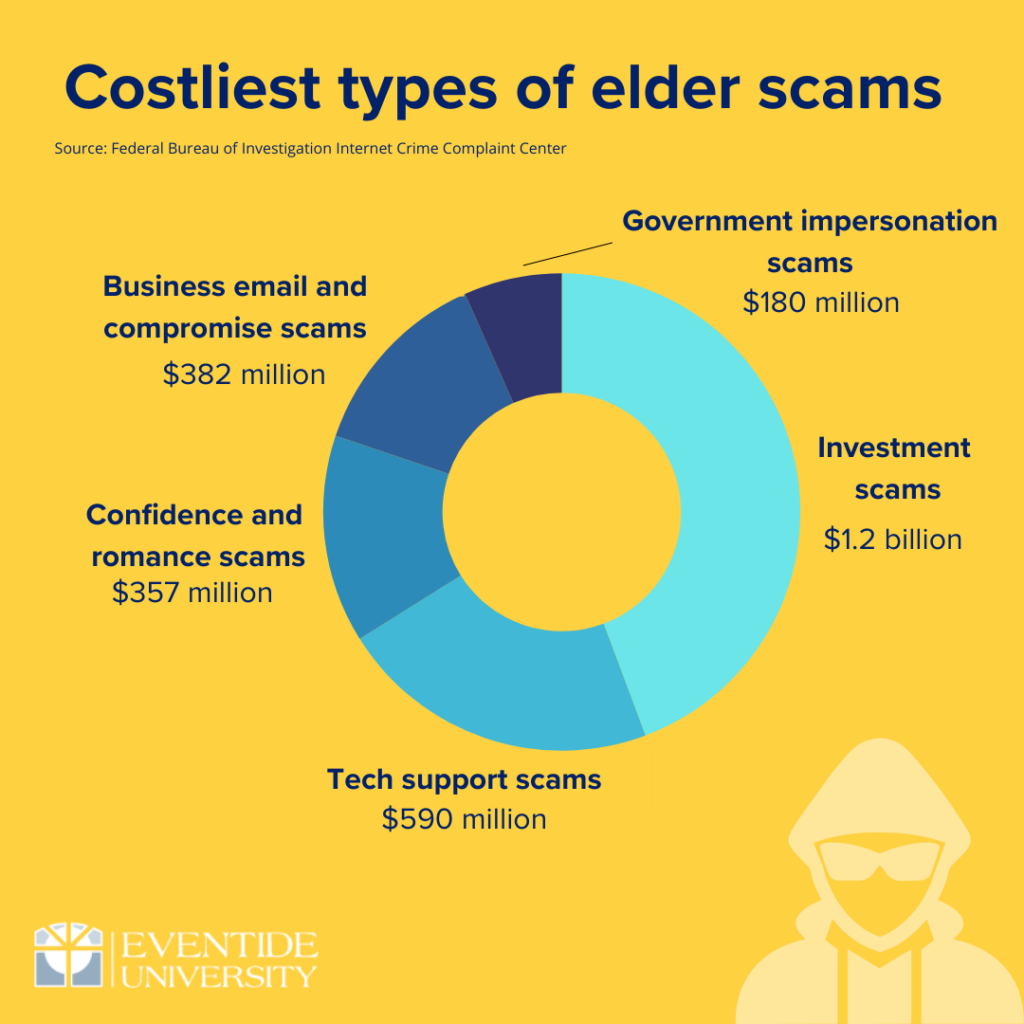

The FBI Internet Crime Complaint Center’s 2023 Elder Fraud Report is an annual publication that provides statistics about incidents of elder fraud—or fraud that explicitly targets older Americans’ money or cryptocurrency—that are reported to IC3. The report aims to raise the public’s awareness of this issue and to prevent future and repeat incidents.

This article is part of Eventide University, a program dedicated to the pursuit of lifelong learning and access to education at every age. Visit eventide.org/eventide-university for more information and upcoming courses.